By Dana Kornmeier ’14 | Staff Writer

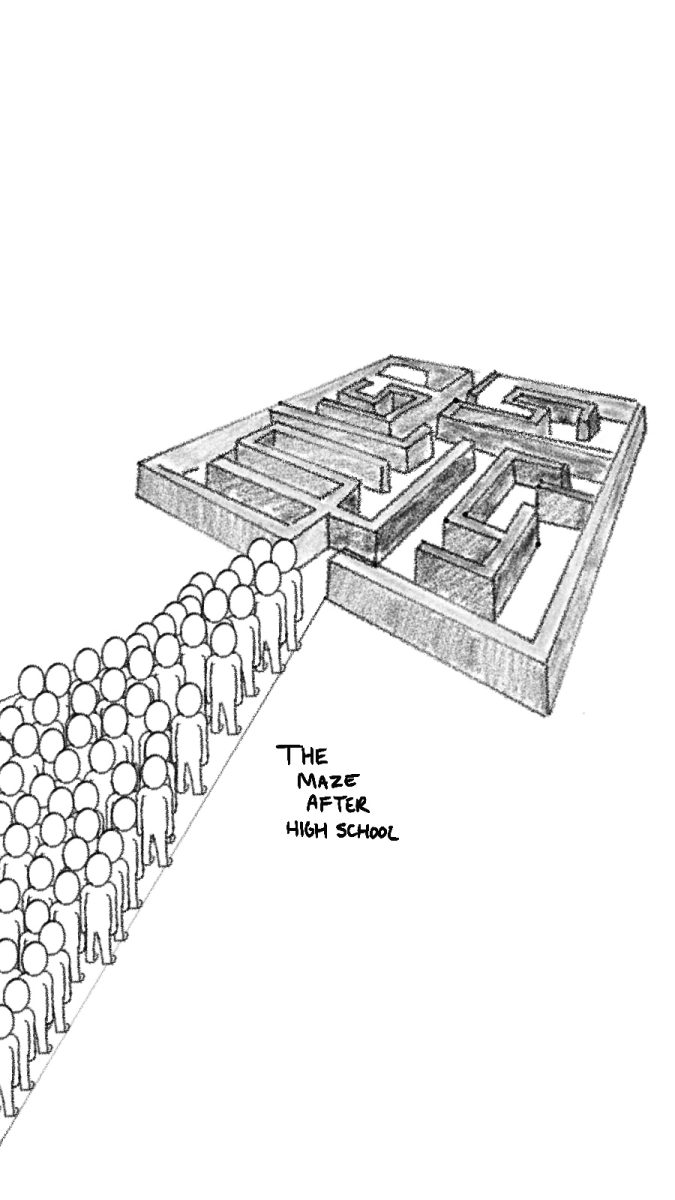

College searching and applying is coming to an end for seniors, acceptance letters are arriving, decisions for the future are being made, and next school year is quickly approaching. The important question for this year’s seniors: how will this college education be paid for?

The most important component of public financial aid is through the Free Application for Federal Student Aid (FAFSA), Counselor Beth Walsh-Sahutske said. This applies to all students that are anticipating being in college for the following academic year, and their parents should apply as soon as possible.

“There’s an X amount of dollars, and once you submit your application you have to verify it with the government and schools,” said Counselor Troy Glasser. “Once those dollars are gone, they’re gone. More important than the deadline itself is when you can submit it, so the sooner the better.”

The FAFSA has been open for application since January 1 and its deadlines vary widely; they are set by federal and state agencies, as well as individual school financial aid offices, according to the Student Financial Aid Services Inc. website. The state of Michigan’s deadline is this Saturday, but students and parents should also look to the specific schools to which they are applying and their specific deadlines.

“I think it’s a good idea to get the FAFSA done the earlier, the better,” said Walsh-Sahutske. “You have to use tax information and forms, and some people don’t get them or are not doing their taxes right away, but you can always estimate. You should estimate and get it in, then you can always go back later and make adjustments once you have final numbers.”

Filling out the FAFSA is entirely online, where you are able to directly link it to your taxes and other online government information, Walsh-Sahutske said. Completing the application should take no more than an hour to hour and a half, and is especially quick when parents know their income and can estimate their annual income, Glasser said.

“Think of the FAFSA as flipping a switch,” said Walsh-Sahutske. “Just putting in the application sends a message to that college that you’re interested in money. For a lot of schools, that will be the trigger that sends them to give other options that are specific to that school.”

Upon finishing and verifying the FAFSA, one can qualify for three different types of public financial aid, Glasser said. One can qualify for grants, money which is not paid back, a work-study, where an on-campus job is given, or a student loan at the governmental interest rate. Additionally, some scholarships are related to the FAFSA and its form.

In addition to the FAFSA, some schools require filling out the CSS/ Financial Aid PROFILE (PROFILE), nonfederal financial aid administered by the College Board, Walsh-Sahutske said. Since it is a different way for assessing financial need, over 400 schools absolutely require it for any money. It is important to check with your schools’ financial aid offices to see if they need it and its specific deadlines.

The FAFSA and PROFILE are extremely important, but students should start applying for scholarships as well, Glasser said. A complete list of applications are listed on the Career Resource Center website.

“Ultimately, the FAFSA and the PROFILE are all about maximizing public money, but don’t forget about private money,” said Walsh-Sahutske. “Private money is going to be any scholarships you can find on the Career Resource Center website, and local money is awesome because there is a smaller pool of people asking for it. It’s helpful.”

“Do it, the sooner the better,” said Glasser. “It might only be $500, but if you have a resume and essay you’ve done for a college application, you should start applying, because $500 can add up fast. Those are huge.”

[info] Reminders:

- To complete the FAFSA, follow this link.

- The Mothers’ Club Scholarship application can be picked up in the Counseling Center and is due this Monday, March 3. [/info]