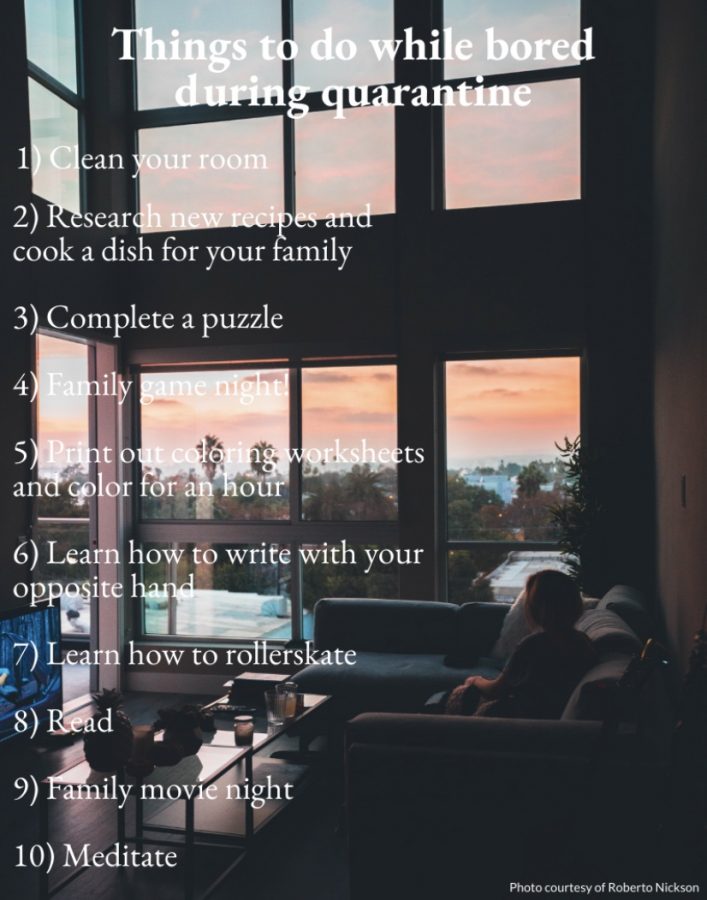

Trump presidency and college tuition

Donald Trump. Photo from Creative Commons.

January 11, 2017

With the advent of President-elect Donald J. Trump becoming President Trump on Jan. 20, many students may be curious or anxious about how his policy may affect tuition rates and college financial aid. After all, Trump appears to be one of the most interesting personalities entering the white house, and many are in the dark on policy in general.

In the short-term, involvements and effects of the Trump presidency shouldn’t have much effect on college tuition rates at all. Like any other government body, the power of the executive branch is rather limited, especially in economy in general. And like any other, the education market is an economy that is distinct from the public sector.

However, unlike most markets, many public universities receive subsidies from the government to ensure the universities operate and keep prices low. Obviously, this hasn’t worked for the most part, as tuition rates are more inflated than those of gasoline. However, private institutions have relatively higher prices, so subsidies have alleviated costs for many students.

In the long-term, though, economy is affected by presidential fiscal policies, and especially with a highly involved market such as post-secondary education. Within two to three years of Trump’s run in the White House, we can expect to see the effects of his policy. So when it comes to the university, what does that policy exactly entail?

As a Republican politician, a large policy when it comes to public-sector fields is to privatize them as much as possible. And according to Money, when it comes to the student loan market, policy director (of Trump’s campaign) Sam Clovis has discussed doing just that. Under a Trump presidency, it wouldn’t be surprising to see the federal government loan market be terminated.

The repercussions of this are quite obvious, as anyone who goes to a private bank to get a student loan knows how underhanded and sneaky their practices can be compared to how the federal reserve loaning service can be. Unlike federal loans, private loans tend to spike in interest rates, despite the initial price being lower for them.

Trump’s administration when it comes to universities may not be all bad for the student, however. According to USNews, both Democrats and Republicans have spoken in favor of risk sharing, a policy that will remove funding for schools that have a rate of students that default on their loans.

This is important because university administrators tend to get as large of a student base as possible, even if they believe that a certain student probably won’t graduate–they still bring loan dollars to the university. That’s why many students are able to go through university without ever taking a course in calculus–to accumulate a larger student body. Risk sharing would disincentivize this exploitive process.

Trump is also in favor of a modification of income-based repayment, according to USNews. This modification would allow borrowers to pay 12.5 percent of their income for fifteen years, after which the loan expires and the debt is forgiven. Undoubtedly, this would be a boon to many indebted students.

Another way in which Trump’s administration may ease the burden of the student is by means of risk-adjusted interest rates, according to Money. With this system, interest rates would vary based on expected earning potential: this is calculated given the individual’s major, university, etc. A mathematics major at Wayne State, therefore, would have a much lower interest rate than an engineering major at Harvard, for example.

Of course, none of these policies are probably going to be implemented. Many Republicans in their dominated legislative branch are adverse to the ideas when it comes to loan repayment. The only policy mentioned here that has a good chance of taking off is risk sharing, which is probably the least helpful to the average student out of all of these.

As for tuition rates, executive administration usually has very little effect on markets as a whole. Prices to important goods are usually misattributed to certain leaders; for example, when it comes to oil price, President Jimmy Carter is seen as a villain while President Barack Obama is seen as a saint. In reality, both had very little effect on this important topic. University tuitions are rather similar.

The one way in which tuition rates can be affected, however, are by means of government subsidies. Given that Trump is Republican, it is likely that he would be more inclined to favor a lack of subsidy to Universities. This is unlikely, though, because Republicans haven’t touched university subsidies in a long time. Additionally, both parties are attempting ways to lower student debt, and lowering government subsidy wouldn’t be one of them.

With President-elect Trump making his debut into the White House, policy on university standards is rather foggy. But generally speaking, don’t expect much change in that regard.