Have you ever made an impulsive purchase after seeing a friend wearing or using something you like? If so, you are far from alone. Teenagers are often influenced by their peers into making decisions in all aspects of life, including financially. According to consumerfinance.gov “An important part of teenagers’ development is taking the time to process and reflect on their money decisions—so they can learn from successful choices as well as mistakes.” Making these financial choices and mistakes are imperative to building a healthy financial life in the future. We at the Tower support students in learning how to budget their lifestyles, but we also encourage them to reflect closely on their choices.

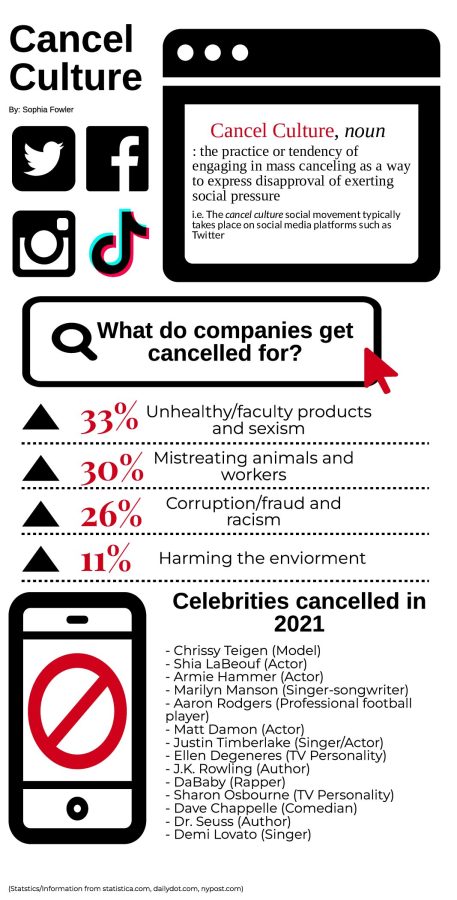

Social Media and the Internet have the capacity to influence many of our decisions. From choosing what to wear to deciding what to eat, we have a tendency to look to others before making our choices and that is amplified through the use of technology. Trends are far more influential ifthey are displayed and advertised globally. Not to mention, making purchases is as simple as clicking a button on your phone. This makes it incredibly simple to purchase unnecessary items while giving it little to no thought. Making your own, independent choices is imperative to building character and setting yourself up for success in the future. This is especially true when the choices pertain to making purchases and financial decisions.

As teenagers in a country driven by consumerism, we are constantly exposed to advertisements. The pressure to make trendy purchases especially appeals to our age group as we desire to be socially accepted. Oftentimes these “trends” come with a high and impractical price tag. A recent example of this is the Stanley water bottle. Within weeks, countless people have been seen carrying around these colorful, overpriced cups. We at the Tower believe that distinguishing between your wants and needs is crucial to setting yourself up for future success both socially and financially.

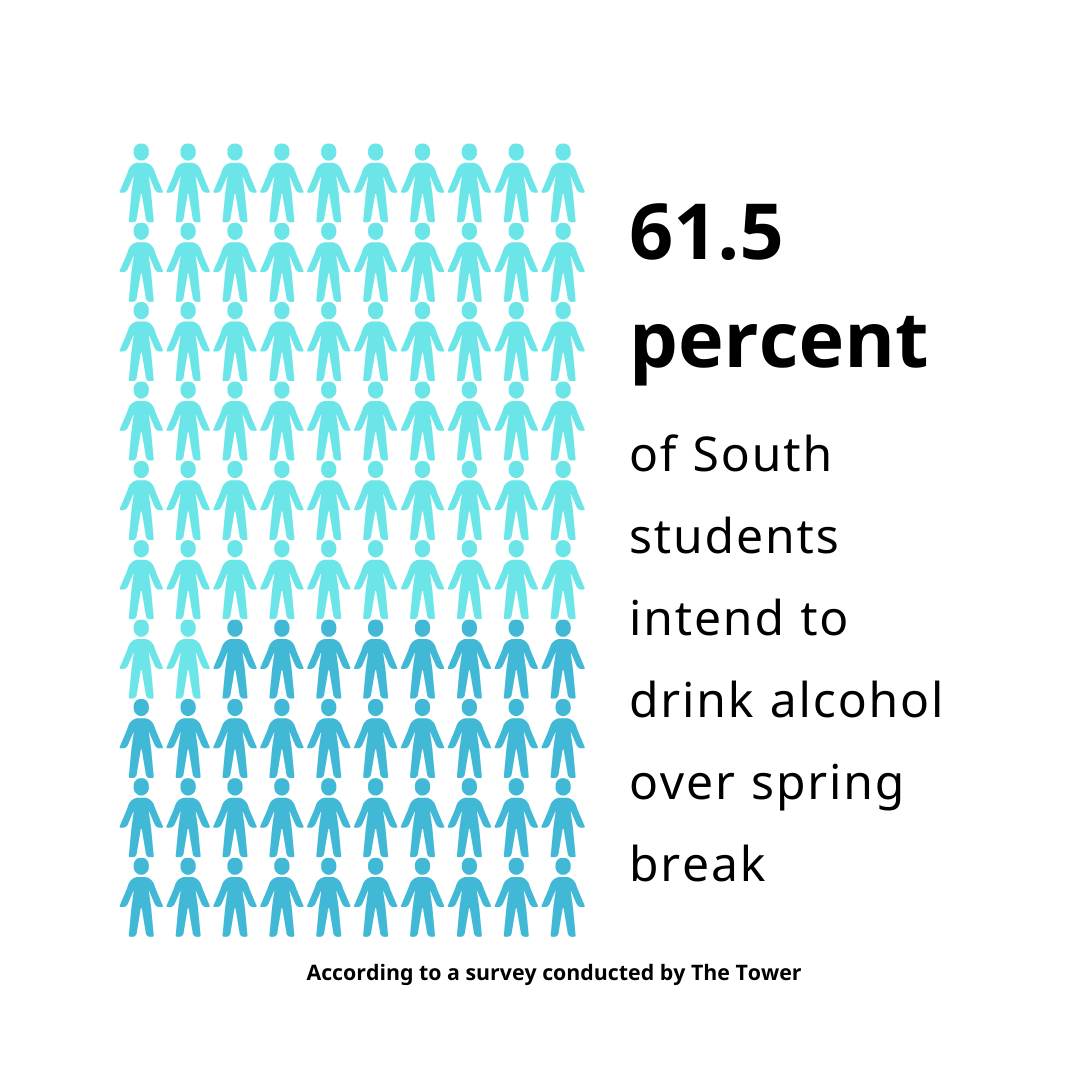

Many students are balancing school and their first jobs. The excitement of seeing your work pay off in the form of a paycheck can be overwhelming. However, learning to budget your money earned is a vital part of life. Countless people immediately blow the money they earn on cute clothes or regularly going out to eat. Though it is important to treat yourself to fun experiences, you must recognize the patterns you are building for yourself. According to kidsmoney.org, the average teen saves 1.9% of their income. This is only half as much as the average adult saves annually. By increasing the amount of money you allocate towards savings, you will have the opportunity to partake in many more experiences throughout your young adult life. Opening a savings account or setting your money aside may not seem important now, but building that habit will make a world of difference.

We at the Tower encourage all students and readers to look closely at the financial decisions they make. Learn to recognize what purchases are truly necessary and which ones are not. Creating these healthy financial patterns in your life is one of the most influential things you can do as a young person.

Categories:

Forming financial habits encourages future success

November 27, 2023

0